Fintech

Stripe guide

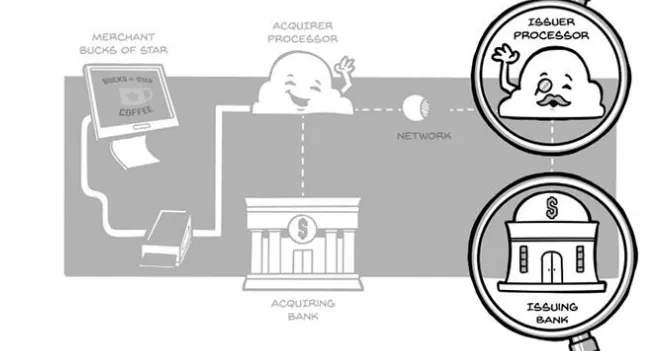

4 players involved in online trans

- Cardholder: person who pays

- Merchant: business owner(client of Solidgate)

- Acquirer: bank who processes payment(Visa, MasterCard)

- Issuing bank: bank of cardholder

Payment Methods

- Credit Cards

- Digital wallets(Apple/Google Pay)

- Bank debits

- Buy now pay later services

- Cash via ATM

Taxes

- Indirect(customer pays)

- US - sales tax

- EU - value-added tax(VAT)

- Canada - goods and services(GST)

- Japan - consumption tax(JCT)

- Physical goods - depends on shop-from. ship-to, product category

- Online - based on local laws

Offline sales - 90% of all sales

- users should have same experience for on(off)line

- payments methods and benefits must be the same

- it its good practice to support magnetic stipe, but it less safe

SaaS

- flexible subsc logic(different types of payment: per month, per order)

- invoice problem: it is must have for big purchases, but must be country based

- minimize failed payment attempt

- send failed payment emails

- send schedule emails

- add backup payment methods

Marketplace

- main problem: you becoming bank-like struct that moves money from buyers to sellers

- problems

- you need to know many info about customers(not to get penalty), but also it makes onboard process more complicated

- moving money

- one-to-one: one customer - one seller

- one-to-many: one big pay - several sellers

- holding: customers pays - seller receives with delay

- account debits: platform takes fees

- subscriptions

Transaction flow:

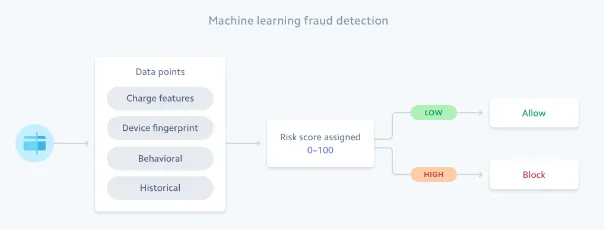

- checkout completion -> fraud protection -> network acceptance Checkout Form

- collects minimal data to make operation

- fast loads, minimal fields, autofill support, UI/UX

- Apple/Google Pay support

- support of local currencies and methods + adapt to local standarts Fraud

- chargback is bad for marchant, cause it must pay chargback fees as well as moneyback

- WAYS TO DETECT

- rule-based

- block transactions from IP, Country, by Amount

- AI

Net acceptance

Net acceptance

- rule-based

- bank will check info and decide to accept/denay

- this decision is made by amount of info and amount of prev operations

PCI standards - security guidelines

-

tokenization

-

3D Secure

-

Anatomy of Swipe

Marqeta - company to create cards and payment рахунки Stripe - money gateway

Visa/MasterCard - Payment Networks of banking system

Money Route(mostly happens by Dual-Messaging)

- Authorization(ISO 8583)(~3 seconds time delay)(holds money)

- message goes from terminal to Acquire Processor with data like(amount, location, card number, Merchant type)

- network provider detected and rerouted

- first six digets are detected(bin - Bank Identification Number)

- bank checks data and decides to approve/not

- is it proper bank

- is card active

- is enough money

- is card can be used

- is it legit activity

- Clearing/Capturing(moves money)(manual/auto)

- Settlement - post moving process when all money moved

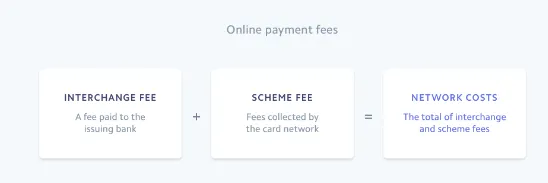

- During settlement Payment Network will take fees and send bills

- Merch Acquirer takes it fees monthly

- when settled operation will be changed from pending to completed A number of parties are involved in money transaction:

- card networks - visa, MC

- merchant acquirer - company that give interface to make payments for merchants

- issuers - banks

chargeback(should be bellow 1%)

- zero liability police insures that customer can mark transaction as fraudulent for free and have moneyback(but card change may/must be needed)

- 30% of reports - stolen cards

- flow

- report -> card freeze -> bank calls for chargeback via Card Net -> transaction goes back to customer -> Merchant is requested to explain and send chargeback with-in 45 days

- merchant reaction

- do nothing and pay

- dispute(impossible if transaction done by magnetic stripe || not likely if CVV won’t present)

- pay fees to dispute

- show proves

- bank covers cost

3D Secure - 2fa like method to make transaction more secure(EU more | US less) EMV - safety standarst(manged by EMV co.)

- 1.0 - done by pin code

- 2.0 - done buy “Yes” button inside mobile app

know your customer

- get some info from your client so you can verify and identify him

interaction types

- swiping - magnetic stipe

- dipping - chip

- tapping - phone transaction

- entering - pc transaction

card network(card scheme)

- main job to pass info from one side to other

- sets rules for sides + format of communication(ISO8583) + format of dealing with problems

- provide a license to use

- TWO TIPES

- Open(Visa and MC)

- don’t do more than just transfer and marketplace function + don’t have favorites

- Closed(American Express)

- may have own cards and banks

- Open(Visa and MC)

- make money buy taking fees per transaction OR with own brand cards

transaction types

- debit | PIN Debit Purchase

- lower fees + pin verification

- Single Message

- credit | Signature Purchase

- higher fees + additional verification

- Dual Message

- auth

- clearing

- if there was fees they will be processed on this stage

- atm

- charges fees from client

- Single Message

neo-bank OR challenger banks - online only banks(mobile-first)

- offers lower fees

- often this is not banks but tech programs that operates under some banks(unregulated often)

banks - only them can move money

- functions

- issue cards to people

- serve as banks to merchants

- facilitate movement of real money

- TYPES(one bank can be both)

- issuing banks

- give cards to people

- know your customer(KYO)

- acquiring banks

- serve as bank to merchants

- legitimate merchants

- issuing banks

- TYPES by interchange

- regulated - big banks(restrictions by law)

- unregulated

each card has BIN(6 digits to identify bank)

taking payments

- work with bank directly

- harder but can give more benefits(lover fees, more customizability, less limitations, use other products to manage payments and hardware, percentage based fees, fast money settlement)

- MINUSES

- paper work

- manage frauds

- work with bank through ISO(independent sales org) - have license to sell banks services

- work with payment facilitator(PF, PayFac) - very quick and gives starter pack(like devices)

- often have fixed pricing

- give tools to deal with chargebacks

- MINUSES

- fixed pricings can be high

- sometimes low variety of options

- all money movement can take days

- flat fees

- (PSP) payment service provider(Stripe) - aggregator for online payments

- Buy Now Pay Later(BNPL) - buyer pays tp some 3d party company for some period, while seller get his money right away(high fees)

best practice - have a merchant experience team to help your merchants and etc flat fees - some amount of money not a percentage

BUSINES CAN CREATE THEIR OWN BRANDED CARDS co-brand partner - brand which is marketing card(Delta airlines who uses American Express card)

program manager - party that controls operations and operations

- frauds, settlements etc

issuer processors - licensed party that holds MIPs of VIPs(hardware from MC or Visa to communicate with them)

- approving/declining + integration and management with merchant + reporting to merchant and bank

JIT Funding(just in time funding) - possibility to smbd to control over some operation in real time(глово може управляти транзакціями кур’єрів наприклад)

KYC(know your customer) - practice to attach identity to user

- usually collect bare minimum to further chek public info about customer

- for gift cards there is procedure that spending is not require KYC, but loading money do

- its important to add another verification method for people that don’t have public info AS WELL AS it’s a good practice to use multiple KYC providers

- for small business there is a practice to check an owner

Credit VS Debit Cards

- Both

- sexteen-digit card number

- expiration date

- cvv

- name?

- Credit

- 30days loan with charge at the end of period

- usually user pays monthly fees

- can be harder to get

- Debit

- lower payment rates for Merchants

- less preferred because of risks that user won’t have money to pay for hotel of smth else

- becoming more popular

Interchange - fee that Merchant pays to Bank of the card owner that payed

- different for each bank and network but main differents are:

- type of business

- each merchant is classified with MCC(merchant category code) - depends on industry

- some categories may be more fraudulent and riskier + different categories have different money amount flow

- each merchant is classified with MCC(merchant category code) - depends on industry

- type of card

- debit and prepaid - “good funds model”(works with real money)

- different because of Network fees(because of Dual and Single Messaging)

- INDUSTRY PRACTISE

- make all debit purchases be in credit mode(some cards can be both debit and credit) as well as turn off pin verif(PIN-less Debit)

- also high fee can be because of Company card vs consumer

- credit fees are caused by people spend more + bank lowers chargeback

- ”regulated” banks have less fees because of law restrictions

- fast banks can have larger fees

- if merchant provide Track 3 data(show all bought products) it can have less fees

- some approach is to create bank+merchant card with super small or no fees(privat label cards)

- type of business

Moving money without network

- ACH(automated clearing house) - bank-to-bank via non-profit org “Clearing House”

- batch based

- used for online payments

- slower

- not all banks are supporting

- Direct Deposit

- often ACH transfer that can be electronic checks analog

- used to pay check for employees

- Peer-to-Peer

- usually based on ACH

- can be virtually immediate but on practice p2p app may move money couple of days

- Zelle

- if users from the same bank send each other money it happens instantly without settlement

- Zelle makes such behavior similar for payments between banks OTHERWISE such transactions are treated as full money moving process

- bank must be connected to Zelle network

- user may need to login and use ids like phone number

- Wire Transfer - way to move money(large amounts) securely between banks

- faster then ACH

- need confirmation and more expensive fees

- need human operator to confirm transaction

- RTP(rela-time payments) - smth like wire transfer but without confirmation and for smaller amount

- near instant

- low fees

- works on push technology

Push-to-card OR OCT(original credit transaction), because no purchase goes along

- fast(instant) because money available to spend instantly(and all moving process is done in background)

- debit based

Virtual Cards

- quick creation process

- online payments of Apple/Google Pay

Expense Reports Alternatives

- OLD WAY

- person purchase from personal card that connected to system

- each purchase is tracked and at the end of the month revisions, corrections and payoffs are made

- PROBLEMS

- can’t limit spends in real time

- EARNINGS // SaaS

- NEW WAY

- person gets virtual card with already set budget + card have one time spend limit

- alternatively person can pay with personal card and then have compensation with in app request

- EARNINGS // Interchange fees